“The 12 Gifts of Retail Christmas” for a Happy New Year

On the twelfth day of Christmas VM-Unleashed gave to me…

No.12 “The Quickest Ways to turn my Average Business into a Best Practice Retailer!”

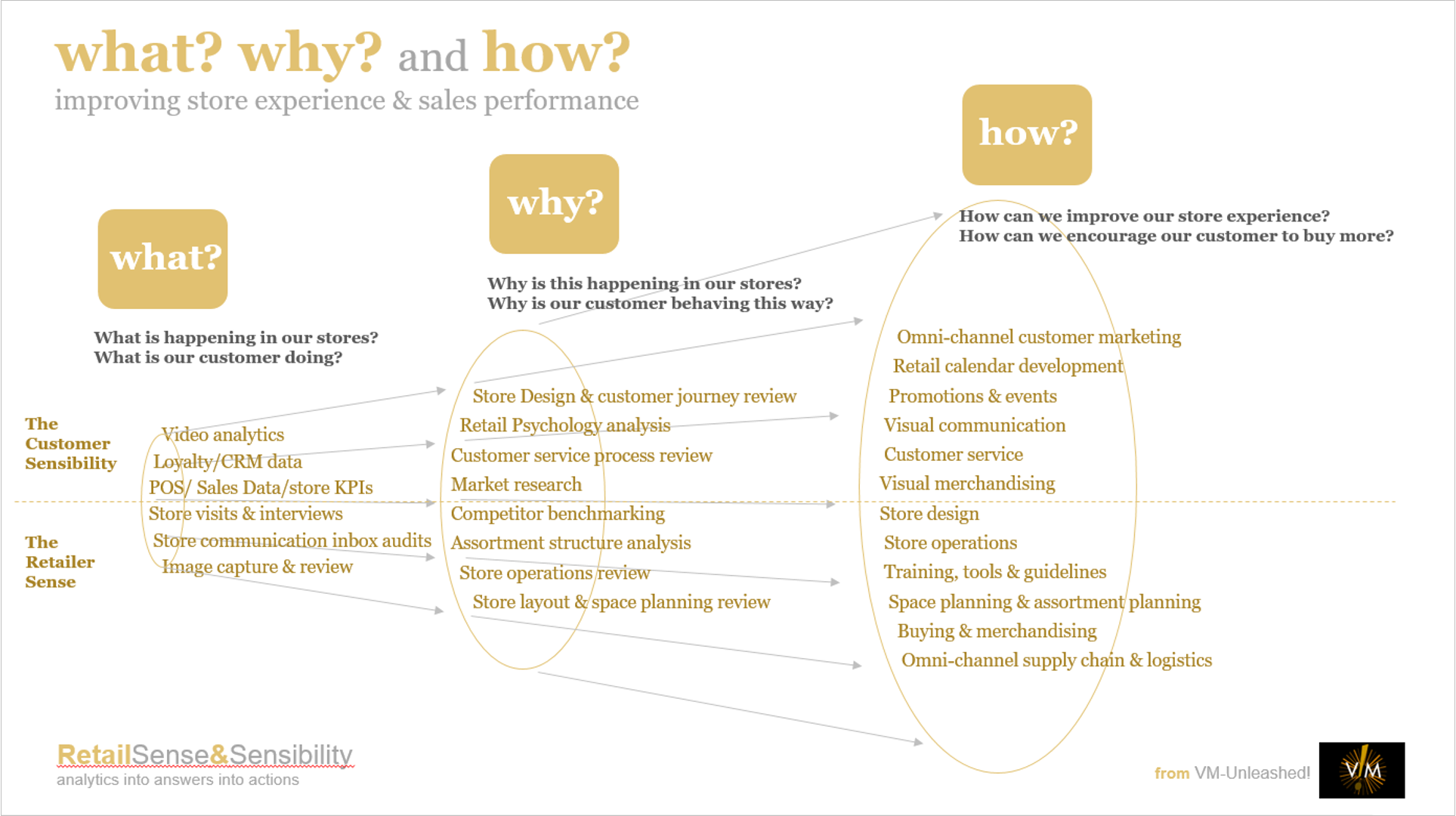

Retail Sense & Sensibility!” analytics into answers into actions

Retail in many ways is the most perplexing of industries as whilst it is built on quantifiable parameters and defined quantities its performance and success quite often seems unrelated to the logic of numbers.

This is, of course, because retail success depends on the emotional reaction of the customer to the product assortment as well as simply satisfying the numerical scale of their apparent requirements.

Improving store experience & sales performance is about understanding the what, the why and the how? Using sense and sensibility.

Sense: the ability to perceive, understand, and judge Sensibility: the capacity to deliver aesthetic and emotional stimulation

It is still a widespread scenario that head office retail functions do not know what is happening hour after hour, day after day, inside their stores.

“What on earth is happening in my stores?!”

Sales volumes, average transaction values, basket values and margins can tell us much, traffic and conversion rates even more, and rates of sales, weeks covers, sell-out rates and sales densities can tell us even more about best seller products and trends and general sales productivity. Knowledge and insight of these KPIs is essential to best practice retail.

Whilst this data tells us what is happening in our stores, however it is arguable that of even more potential value is to know what is not happening in our stores – why are customers not buying and adding to our sales data and our knowledge?

To this end, VM-unleashed has developed a range of special services – audits, analysis and benchmarking that explore this missing intelligence using a combination of new technology, retail expertise and a unique way of observing retail stores built up over 20 years of working in best practice international retail.

These tools consider both the “Sense” and the “Sensibility” of stores

Our most popular audit: please click for more information

The “What on earth is happening in my stores?!” Audit

- What is happening in my stores on an hourly & daily basis?

- Is the same thing happening in all my stores?

- Is the customer behaviour effected by store operational deficiencies?

- How are my store functions impacting my sales, efficiency and profit?

- Where are the weak links in what we do in stores?

- Do I have the right number of people in stores doing the right thing?

- Am I communicating correctly with my stores?

- Do my store managers and personnel understand what is required of them?

- Do my head office retail functions need to be more engaged with stores?

- What are my priorities to change to make my stores work better?

- How can I see what is happening in every store, every day?

Our other Top 20 special services: please click on each for more information

1. Space planning & visual merchandising audits

- am I displaying with the correct option density?

- are my display techniques in-line with best practice?

- is my use of props and mannequins appropriate?

- how does the first 1/3rd of my store compare to my competitors?

- is my visual communication saying the right things?

2. Store proposition & customer perception audits

- need to know what the customer really thinks of your store proposition?

- is the customer perception what you intended?

- what elements of the store give the strongest favourable perception?

- what elements of the store give the most negative perception?

- where should you invest to improve the desired & required perception?

3. Store performance audits & analysis

- need to know what really drives your store performance?

- how well is the assortment delivered displayed & maintained?

- does your environment help or hinder sales performance?

- what elements of your store experience really drives sales?

- where should you focus for maximum ROI in your stores?

4. Store dynamics audits & analysis

- do my stores have the correct change of pace?

- are my “rates of sale” suffering from static stores?

- how often should I rotate my displays and change my windows?

- Is my promotional dynamic commercially effective in driving sales?

- how many “waves” of new product should I have, and when?

5. Customer experience, journeys & touchpoints audits & analysis

- what are my most important customers doing in my stores?

- what missions drive customers to my stores most often?

- what journeys are the most lucrative?

- what store touchpoints are most important to turn journeys into sales?

- how should I deliver and manage these essential touchpoints?

6. “Undercover expert!” store delivery auditing

- how can I impartially assess the VM operations standards in my stores?

- how consistent are my stores in implementing guidelines?

- How can I quantify and judge what is largely qualitative?

- do I know where to improve my vm operations?

- do I know which stores offer the best ROI in team training?

7. “Undercover expert-ease!” competitor store delivery benchmarking

- how well do my stores continually compare to best practice?

- are my stores behind the latest delivery mechanics of competitors?

- are we missing important events and seasonal dynamics?

- do competitors have a stronger more attractive promotional calendar?

- are we slow at following and communicating market trends?

8. Customer behaviour video analytics

- how do my customers behave in my stores?

- what is their activity, were do my customers go to and when?

- where do my customers dwell and stop but not convert?

- where should I put my impulse products and best promotions?

- what causes attraction and engagement in my store delivery?

9. Category delivery optimisation analytics

- how do I learn what will make every department perform most commercially?

- which departments need to be in a precise store location to drive sales?

- what are best adjacencies for each category to stimulate purchases?

- which categories need excellent visual display, and which not?

- what departments should I focus my “wandering” sales staff on?

10. Queue performance analytics

- what is the “sweat spot” for queue waiting time linked to impulse sales?

- how do I minimise abandonment yet expose impulse product?

- what should the relationship be between service time & waiting time?

- should service time relate to queue length and items per basket?

- are my customers queuing where I think they should be?

11. Staff scheduling and activity analytics

- are my staff numbers in-line with the traffic activity in my stores?

- how much do the customers’ hourly and daily patterns change?

- do I have stores with similar patterns, by week-day and weekend?

- are my daily task schedules in-line with the activities of the customer?

- am I scheduling replenishment and customer service correctly, or losing sales?

12. Assortment structure & architecture benchmarking analytics

- is my assortment correctly structured by product categories in-line with sales?

- is my assortment correctly focused by end-use and fashion position related to sales?

- is my colour architecture commercial with a correct balance of base, seasonal & accent?

- do I have the correct price architecture with appropriate entry price points, price ranges, average price points, most common prices & number of price points?

- am I losing sales through missing sizes?

13. Assortment end-use and fashion position analytics

- how do I quantify the “taste” of my customer purchases and relate this to sales?

- is there a way to develop a “taste index” against which to benchmark my assortment?

- is my buying correct in-terms of its end-use and fashion positioning to maximise sales?

- how do I learn which elements and attributes of my products deliver the most positive influence on its positioning?

- how do I compare my positioning against my competitors?

14. Product added-value attributes analytics

- how do I find out which benefits and attributes of a product are most important?

- with what priorities do my customers view product enhancements and adornments?

- what qualities of my products add the most value from my customers’ perspective?

- what product design features offer the best ROI in terms of realised margin?

- What is the correct product design hierarchy for each of my product categories?

15. Omni-channel assortment grading & allocation benchmarking

- how should I allocate my assortment across physical and on-line channels?

- what percentage of my stock should I allocate to stores?

- which categories should I focus on selling in my stores?

- what omni-channel services do I need to employ to deliver across channels?

- what store experience features should I employ to maximise the visual impact, proposition and message of the product and the retail brand?

16. International store assortment grading benchmarking

- how should I edit my assortment to appeal to national and local taste?

- should I be displaying my stores with different densities and capacities?

- what differences in local customer behaviour should effect how I lay out my stores, how I group my product and display it?

- what differences in pricing and sales promotions do I need to consider?

- will my approach to customer service, and the training I need to give be different?

17. Sales promotions, pricing & seasonal event benchmarking

- how do I control and stimulate my rates of sale whilst protecting my margins?

- how do I know which sales promotion mechanics are correct for my brand?

- how do I add value to my brand through promotions?

- how do I know which sales promotional strategy and timings to employ to increase rates of sale of slow movers?

- how do I identify when a product requires sales stimulation and how much?

- how do I integrate my newsletter, loyalty club and social campaigns with the stores?

18. VMToolkit & operational efficiency benchmarking audit

- what tools should I have to improve my VM operations and store sales performance?

- how can I improve the collaboration between head office buying and store selling teams?

- what structure, skills and responsibilities should I have for my VM operations team?

- how do I identify and improve issues that hold back store delivery and sales such as space planning, assortment structure, allocation & replenishment?

- which VMToolkit offers me the best ROI?

19. “Shopportunities” – retail location analytics

- how do I develop my retail location into a customer traffic destination?

- how do I know what is the most commercial number and capacity of stores to have?

- what balance of types of stores should I encourage from local independents to

- national chains?

- how can I improve the professionalism and performance of my unique local retailers?

- how do I ensure my retail offer has the correct taste for my priority customer?

20. “One Shop at a Time!” – retail store refreshment

- how do you improve the professionalism and performance of independent retailers?

- how can you find a cost effective way for “hand to mouth” retail businesses to receive advice and professional guidance?

- how can you help improve individual retail stores but for the benefit of the community?

- what can small retail businesses do for “quick-wins” whilst improving fundamental business practices?

- how can you ensure that “cosmetic refreshes” become sustainable commercial initiatives?

Whether you are an established player, or a new kid on the retail block, we can probably help improve your efficiency, your expertise, your store delivery and of course your sales performance and profitability.

I look forward to hearing your questions, whether large or small.

Always expert and easily accessible.

Thank you.

+44 (0)7967 609849

tim.radley@vm-unleashed.com